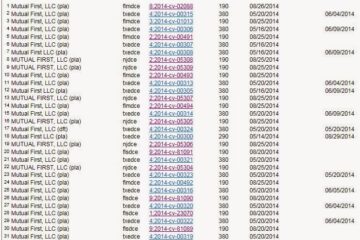

Updated on 11/22/13. On November 14 and 18, Navigators Insurance Company sued three more appraisers to enforce “regulatory claims” exclusions in the E&O policies they purchased. These appraisers are in California and Nevada. Like the appraiser sued by Navigators in Florida on November 6, the new appraisers are being sued by the FDIC for professional negligence in separate cases filed about a year ago. The objective of Navigators’ lawsuits is to seek court confirmation of Navigators’ legal position that there is no coverage under Navigators’ policy for damages awarded against the appraisers to the FDIC, which is demanding about $500,000 from each appraiser, or any coverage for attorneys’ fees and costs to defend the cases beyond $100,000. The FDIC’s lawsuits against the California and Nevada appraisers are scheduled to be ready for trial within the next few months; as a result, the appraisers now each have two lawsuits they must defend: the FDIC’s case and Navigators’ case regarding the insurance coverage. The latest lawsuits can be found at this link on www.appraiserlaw.com. Accompanying each lawsuit as an exhibit is the relevant appraiser’s E&O policy from the Navigators program.

Navigators’ lawsuits to deny the appraisers coverage again relate to the “regulatory claims” exclusion in many Navigators’ policies — a similar version of which can be found in some policies from General Star. I’ve warned appraisers and also lenders and AMCs on this blog about the relevance of these types of exclusions in E&O policies for the last several years. One of my first warnings came in 2011 when “regulatory claims” exclusions first started appearing in policies sold by General Star: “Some Appraiser E&O Policies Now Exclude FDIC or Other Regulatory Agency Claims,” April 8, 2011 (that earlier also post provides detail about how to identify “regulatory exclusions” and where/when they may apply in specific policies). We are now seeing those exclusions come home to roost in actual cases.

Second, the coverage problem with the policies for these appraisers relates to a bigger issue which goes back to when “regulatory claims” exclusions were first introduced by some appraiser E&O programs. In 2010 and 2011, a popular E&O program for appraisers by insurer General Star was discontinued with the program administrator. The General Star policies in that program did not have “regulatory claims” exclusions, but General Star undoubtedly realized that the FDIC and other regulatory agencies were more frequently suing over appraisal problems. When that program was discontinued, most of the appraisers with old General Star policies were moved to new policies from both Navigators and General Star. Some of these new polices (depending on the state with Navigators and depending on the date of coverage with General Star) now included “regulatory claims” exclusions for the first time. Some appraisers have told me that they did not realize the change in their E&O because they never expected a policy for appraisal work would exclude coverage for claims by a banking regulator like the FDIC which is known to sue appraisers. It is possible that the FDIC or appraisers have realized these issues and will now be raising them in response to the lawsuits filed by Navigators.

Navigators has released a statement about its coverage lawsuits against the appraisers. That statement is included in a later post here.

“Regulatory Claims” Exclusions Are a Problem for Appraisers Beyond FDIC Lawsuits.

Looking at the last line of the above regulatory claims exclusion of the General Star policy, it also states that “this exclusion applies to any ‘similar entity or organization’ whose mission is to . . . insure . . . any financial instrument of customers or financial or depository institutions.” To this lawyer, that means and includes the FHA because it insures mortgages and thus also means that appraisers with this particular policy would have no coverage for claims brought by or on behalf of the FHA.

Peter Christensen is an attorney who advises professionals and businesses about legal and regulatory issues concerning valuation and insurance. He also serves as general counsel to LIA Administrators & Insurance Services. Peter can be reached at [email protected].