Efforts to regulate the provision and use of “property data collectors” in connection with appraisals are being made in some states.

In Mississippi, a bill was introduced last month that would have required the state’s appraiser board to license and regulate the field of property data collectors. Under the bill (HB 1633), a property data collector would have been defined as an individual or company, who is not a licensed appraiser and “who collects, either physically, virtually, or digitally, any information on real property, and produces such information to a licensed real estate appraiser who uses it in the course of forming an opinion of value.” The bill would have made it unlawful for any party to act as a data collector without an appraiser license or property data collector license. As introduced, and being the first proposed legislation regarding property data collectors, the bill was perhaps “rough around the edges.” For example, the proposed definition of property data collector might have included sales data information providers. The present bill also referred to requirements for data collectors established by the Appraiser Qualifications Board, which do not exist.

HB 1663 failed. It died in committee.

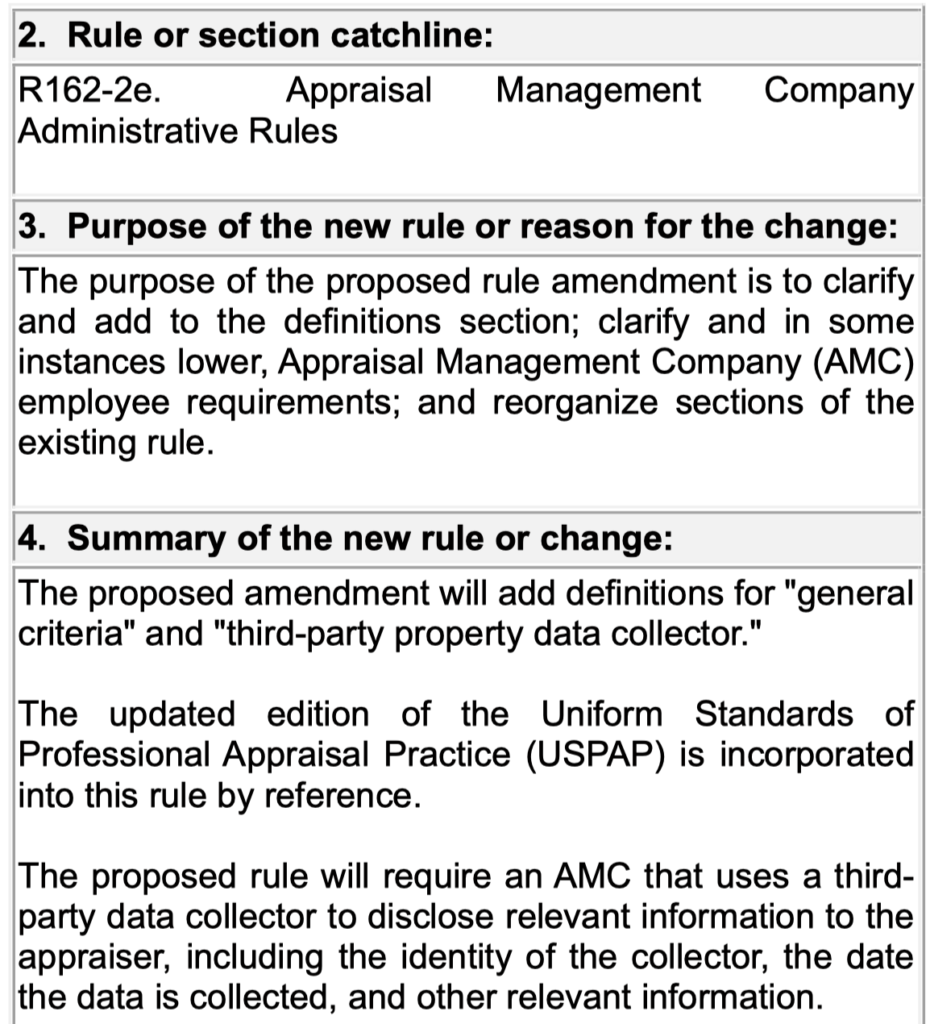

A more modest effort to regulate the use of property data collectors, however, is alive in Utah, where the Division of Real Estate has proposed amendments to its administrative rules for appraisal management companies. These changes were first proposed in July 2023 and are getting closer to potential implementation. Under the revised rules, a “third-party property data collector” would be defined as a “a person engaged to collect relevant property data characteristics or who conducts a property site visit of the subject property for use in a valuation assignment performed by an appraiser.” The revised rule would then require that if an AMC were offering an assignment that will require an appraiser to consider information from a third-party property data collector, the AMC must provide the appraiser with “adequate information to enable the appraiser to determine whether credible assignment results can be produced” including the date of collection, identity of the collector, and “other relevant information” (which is not defined in the proposed rule revision).

Of course, the above rule would only apply to third-party property data collection for appraisal assignments managed by AMCs. Lenders would not be under any restriction.

The full proposed rule change, published March 15, 2024 in the Utah State Bulletin, is here: Utah Proposed AMC Rule Changes, Including Data Collector Additions. Utah’s Division of Real Estate will hold a public hearing on the proposal on April 9, 2024.