| Mutual First Cases, 5-1-14 to Present |

Some appraisers are now being targeted in lawsuits by entities named “Mutual First, LLC” and “First Mutual Group LP.” So far, they are behind the filing of about 40 lawsuits within the last year. They are not banks, credit unions or any kind of regular financial institutions. They are investment entities aiming to make money by suing appraisers. They acquire foreclosed loans for small fractions of the original principal amounts — or most recently, just acquire the right to sue an appraiser over a foreclosed loan. They then file lawsuits against the appraisers who performed appraisals years ago for the lenders, though sometimes the appraisals were not for the lenders who actually made the loans.

In the lawsuits, Mutual First and its cohort First Mutual claim that the appraisers are liable for damages as the result of negligent overvaluation in the appraisals. The damages demanded include the full unpaid balance of the long-ago foreclosed loan (some were foreclosed 4-5 years ago or more).

The background information that I have described below makes it seem very unlikely that Mutual First/First Mutual will succeed against appraisers in the long term. I am confident they will fail. Their track record over the last year is already bad. Nevertheless, I am also confident that until the plug is pulled by investors, they will be a nightmare for dozens, perhaps hundreds, of appraisers dragged into their lawsuits.

According to demand letters preceding the lawsuits, the litigation is managed by an entity using the name Savant Claims Management, though the parties operating it also sometimes use the names or entities Savant Legal Group and Savant LG. These are not law firms; they are claims processors (according to Savant’s own website). The people who work for them use titles like “claims director” and “discovery director.” However, to actually file lawsuits, they must use law firms. One of those firms behind the first round of lawsuits is named Lloyd Ward & Associates, PC. The work of that firm’s attorneys/personnel and other debt-related businesses tied to them has led to notable controversies and has been the subject of legal media attention and litigation (Examples: WA appellate decision, OH appellate decision, 2011 Conn. Dept. of Banking Cease and Desist Order imposing $500,000 penalty); its namesake attorney was suspended from the practice of law by the Texas bar for a period in 2013. Interestingly, both Lloyd Ward & Associates, PC and the other law firm responsible for filing Mutual First’s most recent court complaints use the same email address at “savantlg.com” for communications regarding the cases, suggesting that Savant has a hand in the day-to-day administration of litigation. Suing appraisers for professional liability appears to be a new area of work for these firms.

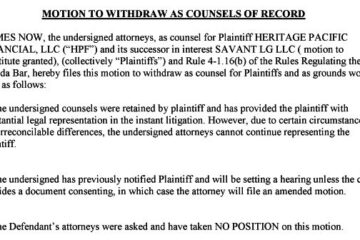

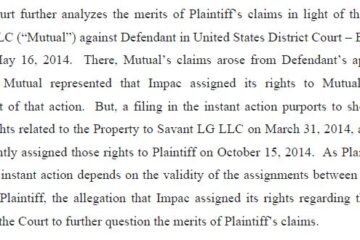

Back to Savant Claims Management. According to marketing literature circulated by a third-party investment promoter: “The directors of Savant Claims Management, LLC have been collecting on sub-prime mortgage portfolios since the market crash in late 2008.” A recent court filing indicated that two of these Savant “directors” are the sole members of Mutual First. These individuals do have a history of trying to create investment returns through litigation involving defaulted debt. One of their last ventures was known as Heritage Pacific Financial, which ended in bankruptcy earlier this year. Before its financial failure, most of Heritage Pacific’s litigation efforts were directed at trying to collect from borrowers. Those cases produced a backlash of counterclaims and lawsuits by some borrowers for alleged wrongful collection practices, even a proposed class action, and a few significant monetary judgments by other parties against Heritage Pacific itself. Prior mortgage/debt investment ventures are also beset with lawsuits by disgruntled investors (HP Debt Exchange, LLC and HP Locate, LLC).

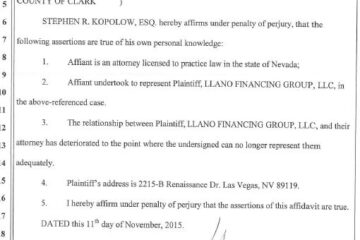

A small part of the bankrupt Heritage Pacific’s litigation involved suing appraisers over appraisals for the defaulted debt. In the cases I observed, Heritage Pacific did not succeed financially. One of the appraisers sued by Heritage Pacific, in fact, obtained a judgment against the company for his legal costs after the court dismissed the case. Nevertheless, the marketing literature from the promoter seeking investments indicated that the upstart Savant’s business model will focus on suing appraisers, asserting that appraisers make better targets than borrowers. Mutual First and First Mutual, in fact, did start suing appraisers late last year in Florida state court. As of this date, they don’t not seem to be pursuing those cases actively, and the only case I have observed reach a final resolution was by way of a voluntary dismissal requested by Mutual First after the defendant appraiser filed a motion to dismiss.

In May, the companies then tried a different tactic by filing 17 new cases against appraisers in federal court in the Eastern District of Texas. That court is known as the “rocket docket” because of the speed in which it handles cases, and the third-party investment promoter stated that cases would now “go from file to trial in less than six months!” Their rocket misfired on the launch pad. The appraisers they sued in Texas did not reside in Texas, which promptly caused the court to ask for legal justification supporting why the cases belonged in the Eastern District of Texas. Shortly thereafter, Mutual First and First Mutual requested dismissal of all 17 cases before the appraisers even had to respond.

Now, it appears that they have begun filing cases anew in federal court in Florida and New Jersey. In late August, Mutual First sued at least 17 appraisers in those courts, including several that it had previously sued in Texas. More recently, Mutual First “transferred” its position in some of those new cases to its cohort First Mutual. It remains to be seen if they and/or Savant intend to follow through with a grand plan to sue hundreds more — to that end, the investment promoter circulated scenarios involving the hypothetical filing of hundreds cases, potentially even more than a thousand cases, against appraisers. Based on my experience in seeing the outcome of thousands of appraiser professional liability cases, however, I think it’s very unlikely a campaign like that would succeed because the proposed returns in the investment scenarios depended on unrealistic assumptions being met; two key assumptions were that they would settle 80% of their cases and recover an average of $50,000 in each case. These assumptions do not reflect the reality of professional liability claims against appraisers. The assumptions also seem disconnected from sound analysis of the legal merit of the claims to be pursued and their ability to present admissible evidence at trial (the investment scenario also did not anticipate any trials). But these are lessons any actual investors would have to learn for themselves.

If Mutual First/First Mutual or Savant pursue the scenarios offered by the investment promoter, they would eclipse the number of lawsuits filed by the FDIC itself against appraisers since 2007 in connection with its receivership of more than 500 failed lenders. However, the FDIC’s own financial experience suing individual residential appraisers suggests that it is very unlikely that such litigation effort would pay off as an investment. Suing residential appraisers hasn’t worked for the FDIC overall, even though the FDIC has many more legal advantages in its favor than a private litigant, including a specific statutory extension of applicable statutes of limitation. Moreover, in 2011, an investment fund that I wrote about in a post at the time — LSF6 Mercury REO Investments — tried to implement the same kind of strategy. That fund was affiliated with the large hedge fund Lone Star. After about 50 cases, LSF6 and Lone Star gave up and filed no more. It would be an even harder strategy to make pay off now because we are almost three years further past the time of the mortgage-boom loans that are the subject of these lawsuits.

Looking at all this from another point of view: what if these companies actually were to succeed with the scenarios put forth and systematically recover tens of millions of dollars against thousands of residential appraisers? Such success would fuel more rounds of litigation by this venture and new ones. If they succeed, they would have a bigger effect on the business of residential appraising and likely put more appraisers out of work than any other of the recent events affecting the industry: the mortgage meltdown, the HVCC, and rise of the AMC-business model. I don’t think this is going to happen but a number of appraisers unfortunately will likely be sued before the investors pull the plug. It’s sad to me that those appraisers will be dragged through Savant’s litigation mill, but maybe it’s sadder that apparently there are some appraisers doing reviews for the purpose of assisting the operation. A review is not just an appraisal review when it’s being used to support litigation like this.

If you are an appraiser and you are contacted by either Mutual First, First Mutual or Savant Claims Management — or any one appearing to operate like these entities, I suggest that you immediately contact your professional liability insurance provider and discuss the threat with them or seek out independent legal advice if you are not insured, and I suggest that you do not provide any information or respond to either company before then.