On October 7, I presented a 4-hour class entitled “Appraisal Discrimination Investigation Training” to state appraiser regulators (board members, administrators and counsel) at the Association of Appraiser Regulatory Officials (AARO) meeting in Salt Lake City. My goal was to offer guidance as specifically relevant to investigating alleged appraisal discrimination as possible. This was based on my experiences in handling current HUD, CFPB and state appraiser board investigations (as defense counsel), my work with fair housing organizations and advocates, and consideration of existing resources.

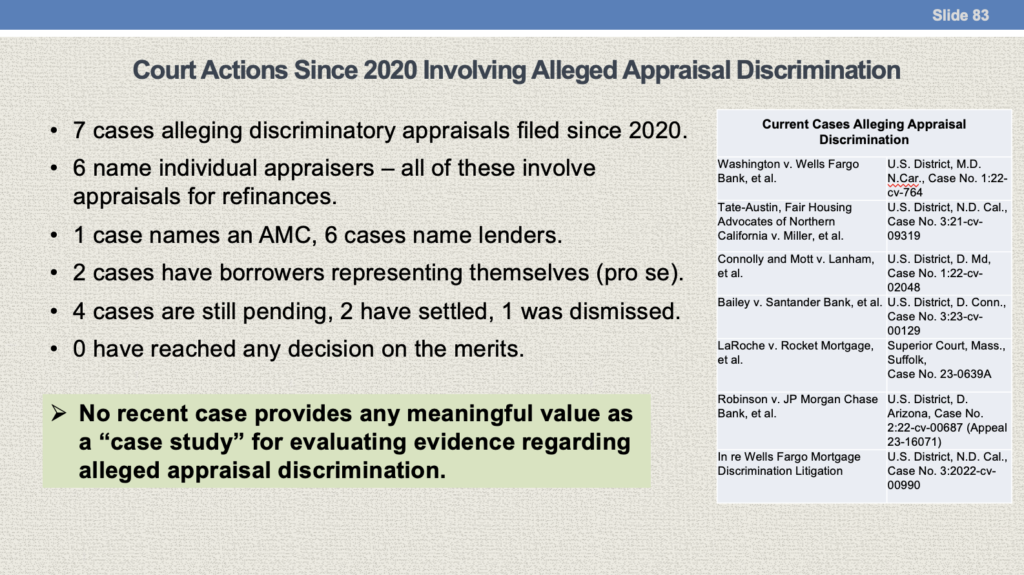

One point I conveyed was about the scarcity of resources for how such appraiser investigations should be pursued – for example, what evidence has been perceived as probative in determining whether an appraiser acted with a discriminatory motive under the Fair Housing Act? Part of the reason for that scarcity is because there are fewer court cases alleging appraisal discrimination than most regulators and industry participants realize. Below is the summary I offered regarding recent cases (slide #83 in my training – please do let me know if I am missing any current cases in the courts).

Appraisers understandably may point to the small number of court cases as evidence that appraisal discrimination or bias does not exist to the degree asserted by fair housing advocates and current federal financial regulators. I’d suggest being careful with that logic – as a general matter, the number of lawsuits regarding a certain activity does not necessarily correlate strongly with how often the activity actually occurs. Moreover, fair housing advocates offer counterpoints such as: (1) most appraisers know that commentary regarding people in protected classes should never be included in appraisal reports – and successfully avoid creating direct evidence of fair housing violations, (2) the evidentiary burdens for proving discriminatory motive are very high, (3) litigation is extremely expensive, and (4) aggrieved parties don’t have wide access to knowledgeable legal counsel. Another consideration may be, to the extent appraisal bias exists, it may be more implicit, than explicit – and that the law and courts do not address implicit bias effectively.

Regardless of the present rarity, I do expect we will see a larger number of new cases filed in the next 6-12 months, as HUD and the CFPB resolve their investigation backlogs.