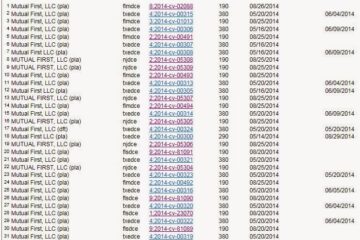

Update: Navigators has sued three more appraisers to deny coverage under the same “regulatory claims” exclusion discussed in the post below. The more recent lawsuits are discussed in this later post.

Yesterday, appraiser E&O provider Navigators Insurance Company filed a lawsuit in Florida against one of its own insured appraisers. In its complaint, Navigators seeks to enforce a “regulatory claims” exclusion in the E&O policy purchased by the appraiser. That appraiser is currently being sued by the FDIC in a separate lawsuit scheduled for trial next month. If Navigators prevails in its legal action against the appraiser, the appraiser will not have coverage under her E&O policy for any damages for which she is found liable to the FDIC at the upcoming trial and will also receive no further payment of defense costs.

The two cases provide an important look at current FDIC lawsuits against appraisers and at a significant hole in some E&O policies marketed to appraisers by some insurers.

The FDIC’s Underlying Lawsuit Against the Appraiser. In February 2007, the defendant appraiser allegedly appraised a condominium unit in Holmes Beach, Florida for $950,000. The appraisal was for a $570,000 refinance loan arranged by defunct mortgage lender Taylor, Bean & Whitaker (TBW). The funds for the loan came from a wholesale line of credit provided by Colonial Bank. TBW allegedly assigned the mortgage to Colonial Bank upon origination. Colonial Bank failed in 2009, and the FDIC is now serving as its receiver. As a receiver, the FDIC has the right and ability to pursue losses it contends resulted from the negligence or other alleged wrongdoing of professionals or service providers to the failed lender, including appraisers.

The borrower ultimately defaulted on the loan, and the FDIC has alleged that the loan is greatly undersecured. It alleges that the defendant appraiser prepared a negligent appraisal report which inflated the value. The FDIC sued her for professional negligence and negligent misrepresentation in a lawsuit filed in August 2012. The FDIC seeks monetary damages against the appraiser equal to the loss on the loan, plus accrued interest and other charges. The FDIC’s lawsuit against the appraiser is scheduled for trial next month, December 2013.

Navigators’ Lawsuit Against the Appraiser. In what is referred to as a coverage action in legal circles, Navigators filed its own lawsuit against the appraiser on November 6, 2013. The lawsuit relates to insurance coverage for the FDIC’s lawsuit against the appraiser under Navigators’ E&O policy. Because the FDIC is an affected party, Navigators’ lawsuit also names the FDIC as a defendant.

In this separate lawsuit, Navigators contends that it has no duty under its E&O policy to defend the appraiser and has no duty to pay any damages for which the appraiser may be found liable to the FDIC. Instead, based on a “regulatory claims” sublimit and exclusion in its policy, Navigators contends that it only has responsibility to the appraiser to pay for her defense expenses against the FDIC up to $100,000. According to Navigators, it has already spent $100,000 for the appraiser’s defense and thus has no further responsibility to the appraiser in connection with her defense or for any damages awarded to the FDIC in the trial next month. Navigators’ lawsuit seeks an order from the court confirming these legal contentions.

If Navigators prevails, the appraiser would then have personal responsibility for any further costs of defending herself against the FDIC’s lawsuit and also would have full personal liability for any damages awarded against her at trial or in settlement. Unfortunately for the appraiser, Navigators’ filing of the lawsuit also means that she must now defend two lawsuits: the FDIC’s professional negligence case against her and Navigators’ action seeking to deny coverage for that case. This puts the appraiser in a very difficult position.

Here are Navigators’ summary allegations in its own complaint filed in the U.S. District Court for the Middle District of Florida in Tampa:

Navigators’ full complaint and a copy of the E&O policy at issue in its complaint are available here.

The FDIC or “Regulatory Claims” Exclusion. The “regulatory claims” exclusion referred to in Navigators’ lawsuit against the appraiser is applied as an endorsement to many appraiser E&O policies currently issued by Navigators in states where appraisers are at higher risk for being sued by the FDIC — as this time: Arizona, California, Florida, Georgia, Illinois, Michigan, Nevada, and Washington. Appraisers often don’t realize they have a regulatory claims exclusion until after they have purchased their policy or, worse, until they are threatened with a claim. The intended effect of the endorsement is to exclude coverage for damages in any claim by the FDIC or by any similar federal or state regulatory agency and to cap the attorneys’ fees available to defend such a claim. To be blunt, the exclusion saves the insurer from the risk of the worst lawsuits currently being litigated against both residential and commercial appraisers. (The FDIC itself has warned banks about new exclusions being found in D&O policies for bank officers and directors and warned about the personal liability that may result. A post about the FDIC’s Financial Institution Letter is here.)

This is the actual exclusion language in the appraiser’s E&O policy relied on by Navigators in its lawsuit:

There are similar FDIC-related exclusions in some appraiser E&O policies from General Star (depending on the date of the appraiser’s coverage), Star Insurance Company, Five Star/Lloyd’s and CNA, as explained in this prior post. However, not all policies for appraisers have FDIC and regulatory claims exclusions. Even in high risk states, coverage without such exclusions is available in LIA’s appraiser E&O program and in competitive programs from Intercorp and FREA.

Peter Christensen is an attorney who advises professionals and businesses about legal and regulatory issues concerning valuation and insurance. He also serves as general counsel to LIA Administrators & Insurance Services. If you need assistance with legal or insurance matters similar to those discussed in this article, Peter can be reached at [email protected].