Updated 12/29/15

Here’s a summary of activity in the last several weeks: (1) Impac/Llano lost a case against an appraiser in New Jersey, (2) Savant’s legal counsel is seeking to withdraw from a case in Florida just weeks before trial (as well seeking to withdraw from up to 10 other cases for Savant/Mutual First/First Mutual Group), (3) a Florida court dismissed a different Savant case in Charlotte County, Florida, based on the statute of limitations, (4) a Nevada appraiser has sued Llano back in federal court, and (5) in some of the cases originally filed by Llano, the decision makers behind the cases have sought to replace Llano as the plaintiff with mortgage pooling entities bearing Impac’s name.

Here are the details for this update:

1. Impac/Llano Lose Case in New Jersey State Court. Llano Financing has filed at least 23 lawsuits as Impac Funding’s “subservicer” in New Jersey state and federal courts. Another related entity First Mutual Group has filed four cases in the state. First Mutual Group’s cases have all been dismissed without any recovery. Llano’s two cases in New Jersey federal court similarly have been unsuccesful. And, last week, on December 7, 2015, the first of Llano’s state court cases was dismissed after the court heard the defendant appraiser’s motion to dismiss. The basis of the appraiser’s winning motion was that Llano had filed its complaint after the expiration of New Jersey’s six-year statute of limitations period. (The case is Superior Court of New Jersey, Union County, Case No. L-3223-15.) The appraiser’s winning attorney was Christian Scheuerman of Marks, O’Neill, O’Brien, Doherty & Kelly. The losing attorney for Llano was Philip Kahn of Fein, Such, Kahn & Shepard — the firm represents Llano in most or all its remaining New Jersey cases.

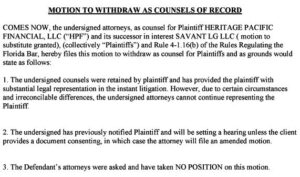

2. Savant’s Legal Counsel Seeks to Withdraw from Cases in Florida. In a case that is slated for trial call just weeks from now on January 11, 2016, Savant’s legal counsel has filed a motion to withdraw from representing Savant. This is one of just a handful of cases that Savant is litigating in its own name (as opposed to assigning to First Mutual or Llano for litigation) and one of the few cases presently pending in this mass litigation that does not relate to a loan tied to Impac Mortgage. The case was originally filed in 2012 by Heritage Pacific Financial (a bankrupt litigation entity managed by the same individuals who are now handling matters for Savant and Llano). Savant took over this case and several others earlier this year, filing motions to substitute in as the plaintiff. The case is most notable, however, because it is first case for Savant (or any of these litigation entities) of which I am aware that has an impending trial date — and if it actually goes to trial, it would be the first opportunity to observe whether Savant and its team can actually take a case to trial against an appraiser. Out of the more than 450 cases filed by Savant and the other litigation entities, I have not seen them take a single case to trial against an appraiser. And, here, with just weeks to go before trial call, their long-time Florida attorneys are seeking to withdraw from representing Savant in the case. The lawyers cite “irreconcilable differences” with their client Savant in their motion (filed on December 15, 2015, in 11th Judicial Circuit Court, Miami-Dade County, Case No. 12-22620CA04). Here is a snip from that motion:

In addition to this case, the lawyers are also withdrawing from 10 other cases (some of them are no longer appear active in the court records) involving Savant, Mutual First and First Mutual Group in Florida.

These lawyers join other legal counsel who have had problems representing Llano and First Mutual Group. In Nevada, after losing two initial motions to dismiss, one lawyer is seeking to withdraw from 20+ cases. In California, the lawyer who filed some of the first cases in that state has withdrawn from those cases, citing non-payment of unspecified costs. And, as detailed in a prior, one lawyer who filed more than 100+ total cases in Florida and New Jersey threw himself on the mercy of a federal court, apologizing for a trail of unpaid court fees in 13 First Mutual Group cases. In his court papers, he wrote: “This is literally a nightmare for me and I am literally shaking as I write this reply . . . I will never take on a client where multiple suits are filed without having an advanced retainer for costs.” All 100+ cases filed by him for Llano and First Mutual Group have now been dismissed, mostly based on technical legal snafus but some based on statute of limitations defenses.

3. Savant Loses Significant Case in Charlotte County, Florida. In one of the cases taken over by Savant that was being handled by the same attorneys seeking to withdraw above, the trial court granted a motion to dismiss with prejudice on December 1, 2015. The basis of the dismissal was that the statute of limitations had expired at the time that Heritage Pacific Financial (Savant’s predecessor in the case) filed the lawsuit in 2013. Very significantly, after lengthy oral argument, the court ruled that the statute of limitation period starting running on the date that the mortgage went into default — a far earlier date, of course, than when the mortgage actually was foreclosed. This meant the period started running no later than when the lender sent notice of default to the borrower. In his comments on the record, the judge found the date of default to be the fairest time for the statute to begin running, as otherwise the party suing the appraiser would essentially control the date and have unlimited time. Savant was seeking “damages of $118,000 exclusive of interest, costs, and attorney’s fees” against the appraiser. The winning appraiser has now moved for an award of costs in his favor. (The case is 20th Judicial Circuit for Charlotte County, Florida, Case No. 2013-CA-000665.)

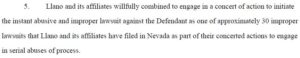

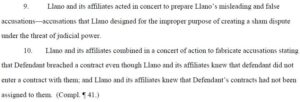

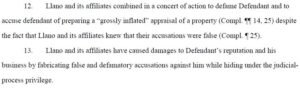

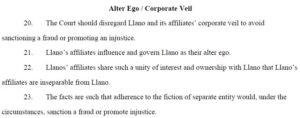

4. Defendant Appraiser Sues Back in Nevada. One of the biggest developments in this mass litigation fueled Impac Mortgage’s subsidiary is that one of the appraisers sued by Llano in Nevada has filed a counterclaim back. He is counter-suing Llano for claims of abuse of process and civil conspiracy. (The case is U.S. District Court, District of Nevada, Case No. 2:15-cv-02074). Here are some of the allegations made by the appraiser against Llano in his counterclaim:

In the last section above entitled “Alter Ego,” the appraiser is asking the court to find that Llano is really just a sham entity and not a truly separate business entity from its operators or owners. The claim is, thus, directed at seeking to hold other people or companies legally and financially responsible for the counterclaims against Llano — such as the principals of Llano, its investors, or perhaps even Impac Funding itself, which assigned its legal rights to claim servicing entities for litigation on a temporary basis but kept control over key parts of the cases and also kept control of the rights permanently.

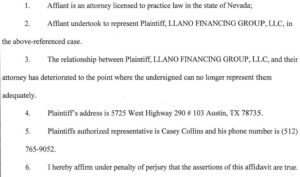

The appraiser’s counterclaim against Llano was filed yesterday (12/17/15). Today, Llano’s legal counsel filed a renewed motion to withdraw from representing Llano. In support of that motion, he stated:

The attorney is also seeking to withdraw from every other case in which he represents Llano.

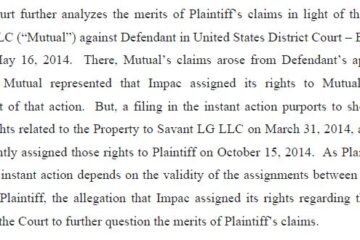

5. Impac-Related Entity Replaces Llano as Plaintiff in Some Cases. This last development may actually be the most significant legal development. Whoever is making the strategic legal decisions behind these lawsuits has decided that it is better, in some cases, to replace Llano Financing Group as the plaintiff with the entity that purportedly owns each foreclosed loan. These entities have differing names depending on the pool of loans — the names are variations of “Impac Secured Assets Corp., Mortgage Pass-Through Certificates, Series [].” This move may have been made because of legal questions raiser regarding the validity of the assignment of claims to Llano or simply because there are now decisions against Llano in several courts. Whatever the reason, it highlights for appraisers that the current wave of mass litigation is fueled by Impac Mortgage Holdings’ various-related entities and loans they have originated, funded or serviced.