Update: Heritage Pacific Financial filed for bankruptcy in January 2014. For information about a new litigation venture against appraisers by some of its former management, please see this newer post here.

These are four of the parties who have been suing the most appraisers in 2011-12. I suspect most appraisers won’t recognize two of the names, unless the appraisers are defendants in one of their cases. The parties are in no particular order, but the last one does file the most lawsuits.

LSF6 Mercury REO Investments. This is an investment fund of a private equity company named Lone Star. LSF6 bought discounted mortgage debt from bankrupt CIT Group in 2008. In late 2011, LSF6 began suing appraisers in New York as part of what appears to be an experiment with mass appraiser litigation to recover damages from appraisers relating to the defaulted mortgages. The mortgages and appraisals at issue date to 2005 to 2007. So far, LSF6 has sued at least 50 individual appraisers and small appraisal firms in New York. LSF6, however, has lost some of its early New York cases or been forced to abandon others. Its masterminds made some obvious legal mistakes. Perhaps seeking a new testing ground, LSF6 filed one of its most recent lawsuits against an appraiser in a Western state. If LSF6’s experiment with mass appraiser litigation pays off for its private equity investors, the appraisal industry will have a dark future of voluminous appraiser litigation.

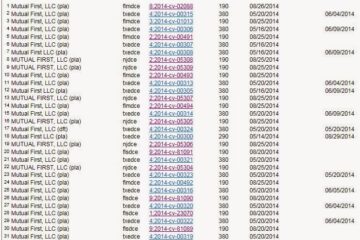

Lehman Brothers Holdings, Inc. This company hardly needs an introduction. It is the financial services firm commonly blamed for the near destruction of our economy in 2008. So, what’s this former giant doing suing individual residential appraisers? Well, one of Lehman’s mortgage origination machines at the height of the real estate and mortgage bubble was its subsidiary Aurora Bank. Lehman acquired mortgages from that subsidiary and packaged many for sale to other parties. Though it filed for bankruptcy in 2008 and remains in bankruptcy, Lehman began filing sporadic negligence lawsuits last year against appraisers who appraised for loans by Aurora back in 2005-2006. These lawsuits have been filed or threatened against appraisers in CA, CO, FL, GA, MD and TN (to name a few states). Lehman filed its most recent lawsuit against an appraiser this month in MI.

Heritage Pacific Financial. This entity is an investment vehicle of some type that purchases defaulted mortgage debt very cheaply and then tries to recover some of the debt through litigation and other means. One of its strategies has been to sue the borrowers for fraud, not just breach of the debt instrument. Because insolvent borrowers rarely fight in court, Heritage Pacific often obtains default judgments against the borrowers without a fight. A judgment for fraud can be non-dischargeable in bankruptcy and thus potentially will remain collectible against the borrower forever (a judgment can be renewed perpetually in California) or as long as judgments are enforceable. The judgments are then either collected on or sold to third parties according to marketing literature about Heritage Pacific. In the last couple of years, Heritage Pacific also has tried to collect from appraisers. It has sued appraisers for professional negligence and misrepresentation, contending that the appraisers are liable for the unpaid loan balances — though Heritage Pacific may only have paid pennies on the dollar for the already defaulted debt after foreclosure.

With respect to its borrower actions, Heritage Pacific is facing at least one class action for unfair debt collection practices. The Center for Investigative Reporting’s California Watch published a report on Heritage Pacific earlier this year (link).

The FDIC’s litigation tactics against appraisers also have been questioned. One of the issues that has been raised both in court and among appraisers is that the FDIC has been using a law firm called the Mortgage Recovery Law Group to make demands on, subpoena and sue appraisers across the country. The firm is staffed by personnel formerly employed by Indymac Bank, which itself failed and is under FDIC receivership. One attorney in the FDIC’s law firm held the title “Director of Quality and Fraud Risk Management” at Indymac. Another non-attorney staffer held the title “Vice President of Fraud Prevention and Loss Mitigation.” In some cases, these law firm personnel play the role of a witness for the FDIC; in other cases, the law firm’s lawyers represent the FDIC as attorneys. A few may think the FDIC’s utilization of former management insiders at the failed bank is clever, but others may think it’s repugnant that former insiders are now profiting from their management work in Indymac’s wheelhouse.

Other cases have raised issues about the FDIC’s selection of appraisers as the principal targets in many of its professional liability lawsuits. The FDIC actually has sued or named in lawsuits more individual appraisers than officers and directors of failed banks. In doing so, the FDIC has looked past the most direct causes of loan losses incurred by the lenders under its supervision, while seeking to push down liability to the smallest, easiest targets. In one of its cases, the FDIC sued two elderly appraisers — husband and wife — over appraisals performed years ago. It truly was the FDIC versus “mom and pop” in this case . . . But, now it’s just “FDIC versus mom” because the husband-appraiser is deceased, leaving the FDIC trying to pin liability on just the widow. In other cases, the FDIC has sued appraisers over appraisals the client never paid for or even appraisals that were forged or altered by third parties.

Honorable Mention: Borrowers Named Alig and Shea (who are the named plaintiffs in a class action lawsuit against appraisers in WV). In June, a law firm named these particular borrowers as the plaintiffs in an alleged class action in West Virginia on behalf of other borrowers in the state against a lender, its affiliated AMC, and two specific appraisers. The plaintiffs further seek to include a class of defendants consisting of all other appraisers in West Virginia who performed appraisals for loans by the lender “after receiving an appraisal request form with an estimate of value on it.” (See this post about the lawsuit.) If that proposed class of defendant appraisers is approved by the court, these borrowers would likely take the title away from the FDIC for suing the most appraisers.

I could add a few regular lenders to the short list above as suing a fairly high number of appraisers and a couple lenders do sue more often than others, but it’s not really newsworthy that appraisers’ named lender-clients sue them.

Does it seem like commercial appraisers have been left out? They should not feel that way. First, in recent months, the FDIC and its outside law firms have begun suing and sending subpoenas to more commercial appraisers. Second, the litigation described above is merely the most frequent, not the most severe. As written about elsewhere in this blog, the most severe lawsuits now pending in terms of alleged damages concern commercial appraisal work.

Peter Christensen is an attorney who advises professionals and businesses about legal and regulatory issues concerning valuation and insurance. He also serves as general counsel to LIA Administrators & Insurance Services. He can be reached at [email protected].