Before I cover a few positive legal developments with regard to the mass litigation against appraisers being fueled by loans held or serviced Impac Funding (a subsidiary of Impac Mortgage Holdings), I think it is important to reflect on the fact that these lawsuits are not impersonal financial matters — they are not “just business” to the appraisers being sued. The frivolous lawsuits filed by Impac’s “claim servicing” agents inflict real harm on individual appraisers and their livelihoods and families. A recent response filed in court by a Florida appraiser brings this point home. In his own words, the appraiser explains to the court that he has been diagnosed with a severe form of cancer and that he and his family are subsisting on government aid — yet, Impac/Llano, as of this date, continue to pursue their lawsuit against him. (I have printed part of the appraiser’s response in a separate post here.)

The good news update for appraisers:

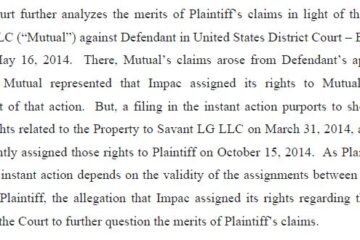

Impac/Llano Lose in Nevada. This morning in Nevada state court, Llano Financing lost one of the first motions to dismiss to go to a hearing in the hundreds of cases filed against appraisers by Impac Funding’s “claim servicing” agents. As background, Impac Funding — a subsidiary of Impac Mortgage Holdings and corporate affiliate of CashCall Mortgage — has been assigning the right to sue real estate appraisers out to Savant LG in exchange for a percentage of the recovery from cases filed by Savant LG or its sub-assignees like Llano Financing and First Mutual Group. (Earlier posts on Appraiser Law Blog provide complete details regarding the mass litigation phenomenon against appraisers regarding Impac’s loans.)

In this particular case decided today in Nevada, the appraiser targeted by Impac/Llano had performed the appraisal at issue about 10 years ago and, according to the court’s ruling, the foreclosure sale had occurred more than 6 years before Impac/Llano filed its lawsuit. Nevertheless, Impac/Llano blamed the loan loss on the appraiser and demanded damages from the appraiser that included the full unpaid loan balance, late charges, attorneys’ fees and costs, and interest.

The winning appraiser was represented by local Las Vegas attorney David A. Clark of Lipson Neilson Cole Seltzer & Garin. The appraiser’s motion to dismiss, alternatively filed as a motion for summary judgment, was based on Nevada’s statute of limitations with respect to Impac/Llano’s negligence claims and based on the non-existence of any plausible contract as to the alleged breach of contract claim. Impac/Llano’s attorney unsuccessfully argued that Impac/Llano’s time period for suing the appraiser had not yet expired. The court rightfully was unpersuaded and further found that the appraisal report did not constitute a contract between the appraiser and Impac/Llano – thus, no breach of contract claim could be supported either. Accordingly, the court granted summary judgment on the complaint. (For defense counsel, the case is 8th Judicial District Court Case No. A-15-722728-C.)

So far, team Impac/Llano is 0 for 1 in Nevada — well, maybe I should make that 0 for 2. Another of the 40+ appraisers sued by team Impac/Llano in Nevada is actually deceased. Apparently, they didn’t check before suing and their process server is having a hard time serving him (may he rest in peace). Coincidentally, First Mutual Group — another litigation entity that has filed Impac-related cases — also filed an unsuccessful case against a deceased appraiser in Florida.

Nevada Update 10/28/15: Impac/Llano lost another case against an appraiser (a former appraiser) in Nevada on October 27, 2015. The case was dismissed with prejudice based on the same statute of limitations grounds. The winning defense attorney was Michael Stobersky of The Law Offices of Olson, Cannon, Gormley, Angulo & Stoberski in Las Vegas. (The case is 8th Judicial district Court Case No. A-15-721528-C.)

Florida Judge Throws Out First Mutual Group Case for Disregarding Court Orders. Speaking of First Mutual Group, it also was handed a recent notable defeat. Earlier this week, a federal court judge ruled that First Mutual Group had failed to cooperate with the appraiser’s defense counsel regarding regular court procedures. Judge Chappell of the U.S. District Court for the Middle District of Florida accordingly dismissed First Mutual Group’s case with prejudice “due to this blatant disregard for the Court’s Orders.” Judge Chappell further reserved jurisdiction to hear a motion for an award of attorneys’ fees against First Mutual Group based on its conduct. (This order and other notable published orders involving can be found at: http://www.appraiserlaw.com/Pages/LlanoFinancingImpacFunding.aspx.)

Florida Judge Issues Severe Order Against Attorney Representing Llano Financing and First Mutual Group. In a different case, another federal court judge in Florida entered a potentially severe order against one of team Impac/Llano/First Mutual Group’s attorneys. Judge Roy Dalton took notice that checks submitted by the attorney to pay for First Mutual Group’s filing of six cases against appraisers had bounced. According to the Court, the bounced checks didn’t come from the First Mutual Group itself, however, but rather came from other entities Blue Star Holding Company and Savant LG. Repeated emails about the bounced checks from the Court to a paralegal went unanswered, and the fees have been left unpaid since last year. Accordingly, on October 16, 2015, Judge Dalton issued an Order to Show Cause requiring First Mutual Group’s attorney Henry Portner to justify why he should not be held in contempt of court for failure to pay the fees.

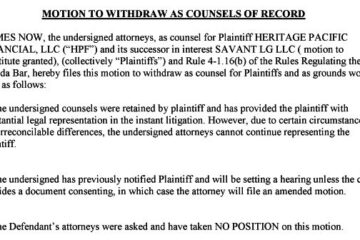

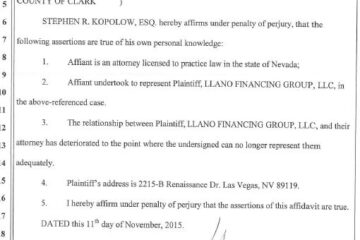

California Law Firm Seeks to Withdraw from Representing First Mutual Group. Bounced checks in the Florida cases might explain why a California law firm has filed motions seeking to withdraw from representing First Mutual Group in several cases. The law firm cited First Mutual Group’s nonpayment of expenses and fees as the reason for its withdrawal. Bounced checks may also be a sign that Llano Financing, First Mutual Group and Savant LG are depleting their funding to pursue litigation. I have seen lots of spending by them on filing new cases over the last year, but I have yet to see a single case that I can confirm as having resulted in any recovery of damages by these three entities relating to Impac’s loans. (If any reader knows of such a case, please let me know.)

Impac’s Association with Savant LG, Llano Financing and First Mutual Group Calling Into Question Impac’s Business Judgment. Outside of what is happening in the actual cases against appraisers, there is also quite a lot of drama relating to the companies and individuals who originally facilitated this mass litigation scheme relating Impac’s loans. I expect we’ll see more information in the future about the parties with whom Impac has aligned itself, as attorneys and appraisers themselves research the background of the people pushing this phenomenon. The court orders and judgments I have personally seen from my own research make me question: how did a publicly traded company like Impac Mortgage (IMH) ever conclude — if it did any due diligence at all — that it was a responsible plan to assign legal claims against appraisers to these entities, to give these entities private consumer records, and to authorize these entities to sue on behalf of Impac as its alleged agents. That will turn out to be a bad decision — whether measured economically or legally. Already, I am hearing from appraisers who tell me that they are refusing or will refuse to perform appraisals for Impac and CashCall because of their ties to the business scheme of suing appraisers for profit.

Peter Christensen is an attorney who advises professionals and businesses about legal and regulatory issues concerning valuation and insurance. He serves as general counsel to LIA Administrators & Insurance Services. He can be reached at [email protected].