First Round. Last fall on this blog and also in the Appraisal Institute’s Valuation magazine, I wrote about several entities involved in purchasing foreclosed debt from lenders (or just purchasing legal claims relating to the debt) and then filing lawsuits against appraisers asserting professional liability claims. Those investment entities were Mutual First LLC and First Mutual Group LLC; and in the background, there was Savant LG LLC, aka Savant Claims Management.

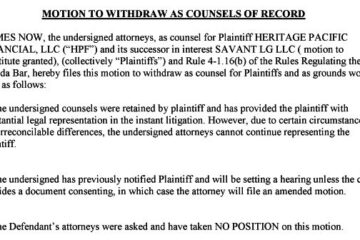

In a first round of litigation, those entities ultimately filed more than 100 lawsuits against appraisers in Texas, California, Florida and New Jersey. So far, it’s been a spectacular failure, showing a lack of due diligence by the investors or their advisers — diligence that should have uncovered the operators’ track record of failure and the court judgments against them by prior unhappy investors in other ventures. I don’t follow every case filed by Mutual First and First Mutual Group, but I have looked closely at most of them and I have not seen a single case among the first 100+ in which the investors actually recovered any money from an appraiser. In fact, more than 80 they filed already have been dismissed by the courts in Texas, Florida and New Jersey because of blundering by their legal team. Many of those cases were dismissed even when the appraiser defendants didn’t show up to defend. Meanwhile, here in California, one of their law firms is seeking to withdraw from working on cases because First Mutual Group has failed to pay them. According to court filings by First Mutual Group, the losing investors behind this entity were two British private equity firms: Alternative Capital Strategies LP and ACS General Partner Limited.

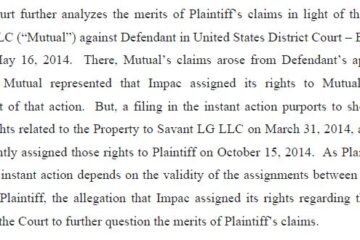

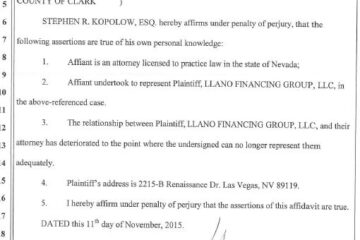

Second Round. Despite the losses and problems in the first round, there is now a second round of cases being filed by different investors. This round is being led by Llano Financing Group LLC, which also acquired the rights to sue appraisers from the same sources. Like the other entities filing lawsuits, this is an investment entity, not a real lender, though its name might have been chosen to sound like a lender. It acquires the purported rights to sue appraisers from lenders or mortgage investors in connection with loans that long ago went into default and were foreclosed. Llano did file nine cases in the failed first round and seven of those cases have been dismissed against it to this date.

In most or all the cases filed by Llano in the second round, the original loans were funded or purchased by Impac Funding which then expressly assigned the rights to sue appraisers to Savant LG, who then assigned those rights to Llano (this is according to Llano’s court complaints). In other words, Impac allegedly sold claims against appraisers to these investors. An example assignment is included here — in the assignment Impac states that it “does hereby assign . . . any and all of its rights to pursue any and all claims . . . against the real estate appraiser(s) and/or the appraisal company.” (The legal validity of Impac’s assignments will have to be tested by appraisers in their defense.)

Another entity recently filing such lawsuits against appraisers is Carrington Capital Management — which is apparently under the same umbrella of ownership as Carrington Mortgage. While the lawsuits being filed now relate to old appraisals, appraisers and appraisal firms/AMCs need to weigh the liability risk that the lenders involved in this large scale legal assault on appraisers are creating for them with regard to current and future appraisal work. When the math is done, it quickly becomes evident that appraisers, individually or collectively, cannot absorb the monetary costs of damages claimed by lenders contending that appraisers are liable for loan losses whenever they can retrospectively find alleged appraisal deficiencies. Appraisal fees just are not high enough to cover such alleged losses.

The latest lawsuits have been filed in California, Florida and Colorado. In the last 3 months, based on assignments provided by Impac Funding, Llano has sued about 270 appraisers and appraisal firms (from the smallest firms to the very largest). Carrington Capital has sued about 10.

Both Llano and Carrington Capital are using different lawyers than in the first round. My estimation is that they lost confidence in the predecessors or did some due diligence regarding the backgrounds and experience of the parties with whom they were dealing. The primary law firm now representing Llano in Florida, where most of the new cases have been filed, is McCalla Raymer, LLC; this a large Southeast regional law firm that does done high volume mortgage foreclosure work for lenders. Although the grand scheme of suing appraisers for profit has failed to this date, Llano and Carrington Capital do seem a little better organized, and appraisers dragged in should take the lawsuits seriously, get legal representation and start mounting their legal defense.