The New York Attorney General’s Office has announced reaching a settlement with CoreLogic, as successor to eAppraiseIT, over the 2007 lawsuit filed against eAppraiseIT by then-Attorney General Cuomo. This was the case, of course, that led to the HVCC with Fannie Mae and Freddie Mac. It also put the AMC liability train in motion, which has kept rolling since — resulting in significant lawsuits filed by both government agencies and private parties against a majority of the 10 largest AMCs.

The NY AG noted that the lawsuit concerned approximately 10,000 appraisals in New York for WaMu in 2006-2007 and described the following terms of the settlement:

The settlement provides that the defendants will pay $4 million in civil penalties and $3.8 million in costs, fees and disbursements incurred during this protracted litigation. In addition, the defendants, who are no longer in the appraisal business, agreed to comply with applicable federal and state appraisal standards if they reenter the appraisal business in the future.

Here is a link to the New York Attorney General’s news release: http://www.ag.ny.gov/press-release/ag-schneiderman-secures-78-million-settlement-first-american-corporation-and

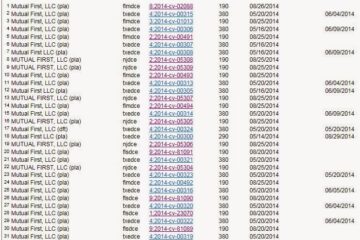

This settlement does not affect the FDIC’s lawsuit against eAppraiseIT/CoreLogic filed in May 2011, in which the FDIC presently seeks approximately $110 million in damages relating to 169+/- specific appraisals for WaMu. The number of appraisals currently in the lawsuit is plus or minus a handful because the FDIC doesn’t seem sure which of the two AMCs it has sued — eAppraiseIT and LSI Appraisal — actually delivered the appraisals in each lawsuit. The FDIC recently had to amend its complaint against LSI Appraisal to add some appraisals it had erroneously sued eAppraiseIT/CoreLogic over.

That’s not the first misstep by the FDIC as far as appraisal analysis problems in these cases. Here’s another example. In its complaint against each AMC, the FDIC alleges that the appraisals delivered by the AMCs and their respective appraisers were “grossly negligent,” which basically means they were performed with reckless disregard for professional appraisal standards. To buttress its case, the FDIC has been obtaining reviews and retrospective appraisals and using different vendor companies to order those services from independent appraisers. At least one of the same appraisers whose work the FDIC labels as grossly negligent in its complaint, performs reviews and retrospective appraisals for the vendor — I suspect there are more. Of course, this does tend to demonstrate that we can’t put any more faith in the quality of reviews or retrospective appraisals used in litigation by parties like the FDIC than in the quality of the original appraisals under attack. But it gets a worse than that here: this particular appraiser was requested to perform a retrospective appraisal for the FDIC of the same property he appraised in 2006/07 that is the subject of one of the FDIC’s two lawsuits.