This is the first of a series of articles that will discuss valuation liability issues which either do not stem from true appraisals or affect parties besides appraisers.

This is the first of a series of articles that will discuss valuation liability issues which either do not stem from true appraisals or affect parties besides appraisers.

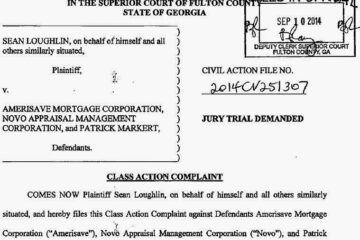

Appraisers are by no means the only parties targeted for valuation liability claims. While appraisers are frequent targets in connection with their own professional work, other parties have much wider scopes of potential liability relating not just to appraisals but also to other forms of valuation, including automated valuation methods (AVMs) and broker price opinions (BPOs). Other parties are also much more exposed to potential class action liabilities relating to valuation. One of the valuation liability issues confronting lenders pertains to their use of AVMs and BPOs in connection with . . .

[A complete and updated version of this article is available to LIA insureds and READI members at readimember.org. READI is the Real Estate Advisors Defense Institute, created by LIA to protect appraisers, advocate on their behalf and provide straightforward information about the legal issues that affect them. You can read more about READI at readimember.org.]