It’s been now been a decade since the market relevance of appraisal management companies surged in connection with the procuring of appraisals for residential lending. Since then, interesting recurring legal issues have arisen relating to AMCs’ potential liability for the work of contractor appraisers: when and how may AMCs be liable for the deficient work of contractor appraisers? Can AMCs be sued for negligence? Can they be sued by borrowers? Here’s an overview of the answers to these questions.

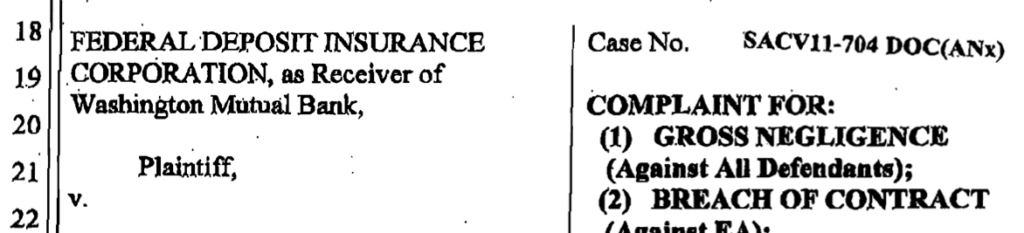

Among the first cases that explored the liability of AMCs for deficient appraisal work by contractor appraisers were the FDIC’s lawsuits in 2011 filed against two AMCs (eAppraiseIT and LSI Appraisal) relating to appraisal reviews performed for WaMu by panelist appraisers. In those cases, the applicable legal claims (contract versus tort) and the parameters of each AMC’s potential liability were very much up in the air. Could the AMCs be sued of negligence? Or, was their potential liability only for breach of the service agreements in place with WaMu? Those questions weren’t fully answered by the cases because they both settled in the end. However, the FDIC struggled to state a valid claim for negligence and its negligence claim against one of the AMCs actually was dismissed on an initial motion – leading the FDIC to accept a much smaller settlement payment than it probably had envisioned when it filed the case. (The FDIC settled for less than 10% of its original $129 million demand for damages against the AMC.)

In the intervening years since those cases, however, the legal landscape pertaining to appraisal management companies – as distinct from true appraisal firms – has changed greatly. Primarily, the biggest difference is that AMCs now conduct most of their services under the requirements of state appraisal management company registration laws enacted in all 50 states. As a result, more established patterns of liability risk for AMCs have emerged.

Can an AMC be liable for an independent contractor appraiser’s deficient appraisal?

In some circumstances, the answer is “yes.” It often comes as a surprise to a defendant AMC that AMCs generally do not escape from a legal action over a deficient appraisal performed by a contractor with the plain argument “we’re not liable because the appraiser was an independent contractor.” For starters, in some cases, the courts have viewed an AMC’s liability just like a true appraisal firm’s. At the prompting of plaintiffs’ lawyers, AMCs sometimes are perceived by courts simply as appraisal firms that use contractors, rather than employees, and thus fully liable for the appraisal work product as if it were the work product of the AMC itself. This kind of conclusion doesn’t reflect a good understanding of the differences between AMCs and appraisal firms, but I’ve still observed courts reach this result when the AMC’s defense counsel couldn’t articulate the differences effectively. (The specific thing that prompted me to post this article was reading a newly filed court complaint filed in Texas by a lender in which the lender’s attorney alleged that the AMC was negligent because the appraisal “grossly overstates the Property’s value by $1,000,000 primarily because of inaccuracies related to the subject’s condition.”)

In other cases, parties suing an AMC point to state appraisal management laws and industry practices as creating a “standard of care” for the AMC itself – the violation of which can serve as the basis for a viable negligence claim. In short, the argument by the plaintiff is that the AMC should be liable for its own “appraisal management negligence” as distinct from the appraiser’s negligence. In particular, plaintiffs point to the common language in state AMC laws obligating AMCs to have a process in place to ensure that appraisals are performed in compliance with the Uniform Standards of Professional Appraisal Practice (though what this means in practice is up in the air). Plaintiffs also point to the contractual assurances and representations about quality control and standards compliance that AMCs frequently make in service agreements, as well as publicly on their websites, as forming standards of care.

And, very clearly, AMCs certainly may be sued by their own clients for breaches of contract pertaining to service agreements. The details spelled out in these agreements play a critical role in shaping an AMC’s legal duties and potential liabilities to the client.

What parties have proven to be the biggest legal threat to AMCs?

By a wide margin, an AMC’s biggest appraisal-related liability risk has proven to be its exposure to claims by lending clients who seek to hold the AMC responsible for loan losses attributed to deficient appraisals. Most commonly in these claims, a loan has been foreclosed and the lender has suffered a significant loss of principal. Armed with hindsight and a critical review appraisal, the lender claims that the original appraisal overvalued the subject, that the AMC should have caught the appraisal deficiencies, and that the lender would not have made the loan if the AMC had done so.

In some instances, lenders even have made claims not just over losses relating to loans in default but also in relation to mortgage repurchases on performing loans. For example, when one of the GSEs observes an appraisal deficiency violating its loan selling guidelines, the GSE may force the originating lender to repurchase the loan. Some lenders then look to the AMC – not the appraiser – to be made whole for the loss it has taken in connection with repurchasing the mortgage.

Lender claims present a bigger monetary risk to AMCs, in general, than claims from other sources (such as borrowers) because of the potential severity of the amount of the claimed loss. While even a claim about a single bad mortgage – say, with a $300,000 claimed loss – has the potential to wipe out an AMC’s profit margin from managing thousands of appraisal orders for the lender-client, the scenario exists – and has occurred – where a lender will stack up the losses on multiple loans, resulting in a multi-million dollar claim against an AMC. This is most likely to happen after a lender already has shifted its business to a different AMC.

Borrower claims against AMCs, however, are actually filed more frequently than lender claims, but they are in most cases easier and less costly to defend. At the heart of the claim is usually a contention that the appraisal was too high or too low, or that the appraisal report misstated the square footage of the subject or failed to report a problem with the property (often the items complained about are far beyond the AMC’s control). The defense of borrower claims is aided by legal vagueness as to whether an AMC owes any legal duty to a borrower. State AMC laws are almost uniformly silent on this point.

Real-world observations from claims

Here are two basic observations I’ve made in actions against AMCs. The first is that some defendant AMCs haven’t appreciated – until involved in a claim – that when an appraisal service such as a desktop appraisal or review, or even a “full” appraisal, becomes commoditized into an inexpensive product, the same level of potential liability may still attach to that inexpensive product. The AMC’s representations and warranties, its indemnification responsibilities, the AMC’s statutory responsibilities and the appraiser’s own key certifications likely aren’t any different and neither are the risks. It’s jarring for an AMC (or appraiser) to be sued for several hundred thousand dollars over a report that produced a tiny margin of profit.

Another common element I’ve observed across multiple claims is the selection of appraisers who were unfortunately not competent to handle the particular assignment that resulted in the claim. Here, the biggest competency problems I’ve observed have related to commercial appraisals and properties outside the average experience of a panel appraiser, such as very high-end residential, vacant development land or agricultural properties. Sometimes the AMC has ventured outside of its own comfort zone to handle a special issue for its regular residential lending client by doing some like handling a one-off commercial or agricultural-related assignment or procuring an appraisal for litigation purposes.

Basic risk management

Prudent appraisal risk management for an AMC, of course, involves consistently executing an appraisal QC and review program designed to ensure that compliant and accurate valuations are delivered to clients. The problem is that even then, appraisals will still flow through that lenders will later claim to be deficient in the event of a mortgage default, and there are many appraisal errors that are outside the AMC’s control. For these risks, the best risk management strategies that an AMC can accomplish are upfront in the service agreement with the lender. That agreement is key because, despite rapid evolution of state AMC laws, many of the legal duties owed by an AMC to its clients remain contractual. In their service agreements, AMCs should pay special attention to:

- The importance of distinguishing between the functions of the AMC versus independent contractor appraisers.

- Representations and warranties with respect compliance of appraisals with USPAP or GSE guidelines.

- Avoiding overly broad indemnification obligations in favor of the lender that go beyond the defense of third party claims.

Some lenders – especially a few of the largest and several of the riskiest (who engage in non-standard or crowd-based lending) – seek in their service agreements to push an AMC to accept financial responsibility “for any and all losses in any way related to” the managed appraisals, regardless of whether the issues are within the AMC’s control. Not many AMCs have the desire, or even financial wherewithal, to back up promises like that in the event of a claim involving a large volume of appraisals.