Updated to reflect new “guidance” from the Appraisal Subcommittee on September 27, 2023.

What if a state dropped its appraisal management company law and no longer regulated AMCs? That’s exactly what’s happened in Hawaii – maybe by accident.

The state has a regulatory “sunset law” (Hawaii Revised Statutes section 26H-4), which automatically repeals any new professional or vocational regulatory program created after 1994 if the program is listed in the law, unless the state legislature re-enacts the program. There are only two programs listed in the sunset law – AMCs and midwives. The AMC program was set for repeal in the sunset law on June 30, 2023. That date came and passed with no action by the Hawaii legislature. Accordingly, Hawaii’s AMC law automatically expired.

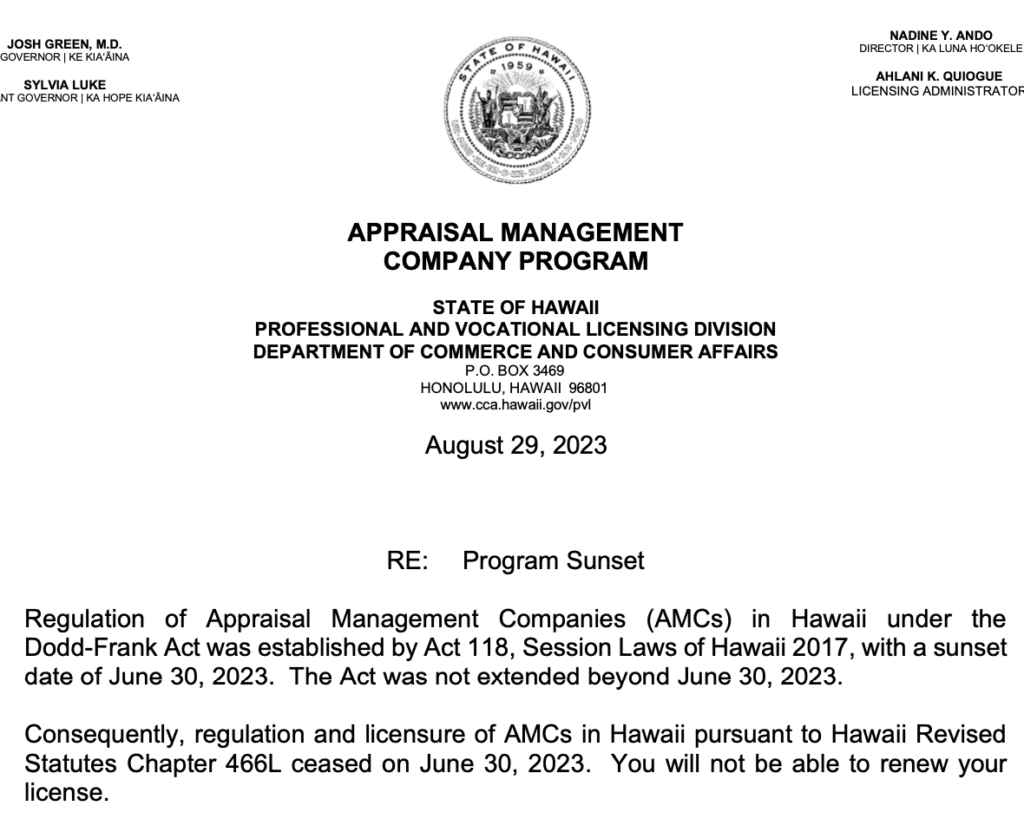

The expiration of the law went unnoticed until Hawaii’s Department of Commerce and Consumer Affairs finally announced the demise of its AMC registration program on August 29, 2023 via a posting on its website. Indeed, to this date (August 31, 2023), the department still lists AMCs as currently licensed through December 31, 2023 – all having paid Hawaii’s $5,000 AMC license fee. In its announcement, however, the department states that the AMC law was repealed effective June 30, 2023. In FAQs attached below, the department further has advised that AMCs that meet the federal definition of an AMC (which mainly means having a panel of more than 15 contractor appraisers in one state or 25 or more appraisers nationally) may no longer provide appraisal management services for federally related transactions in Hawaii, citing section 1124 of FIRREA (12 USC 3353). But, at the same time, it also indicates that the state will not enforce the prohibition.

Is Hawaii right or wrong about the effect of the prohibition? That’s a question perhaps better answered by federal financial regulators, than by Hawaii’s Department of Commerce and Consumer Affairs. The relevant part of FIRREA section 1124 (12 USC 3353(f)(1)) states: “No appraisal management company may perform services related to a federally related transaction in a State … unless such company is registered with such State or subject to oversight by a Federal financial institutions regulatory agency.”

On September 27, 2023, the Appraisal Subcommittee, whose members are the federal financial institutions regulatory agencies, provided the following revised “guidance” – I’ve put guidance in quotes because it doesn’t help with the fundamental question of exactly what do the regulators really consider to be federally related transactions under their respective regulations? There are lots of differing interpretations and opinions on that from state and federal regulators, as well as lenders and AMCs.

What’s next? There will not be a quick legislative fix for Hawaii’s AMC law, because the state legislature has adjourned. Any such potential fix won’t come until next spring at the earliest. Accordingly, AMCs that meet the federal definition of an AMC will be considering their options and looking closely at the meaning of “federally related transaction” and its numerous exceptions.

…