Can chief appraisers and other managerial appraisers at banks be sued for failing to fulfill their responsibilities with regard to oversight of the bank’s appraisal functions? Yes, they can and have been sued. The types of actions they have been named in range from fraud actions by private plaintiffs, to whistleblower suits by other employees, to cases filed by government agencies after a bank’s failure.

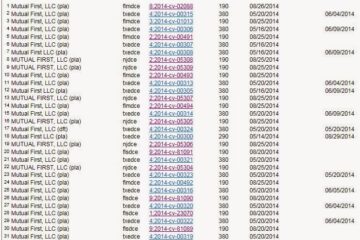

Has the FDIC sued any chief appraisers in the current spate of bank failures that began in 2008? No. Not yet. While some chief appraisers or other managerial appraisers have captured the investigative attention of FDIC attorneys, the FDIC has not named any as defendants in any of its 490+ lawsuits since January 1, 2008. In fact, so far, the FDIC actually has blamed a few failed banks’ officers and directors for disregarding advice or information supplied by chief appraisers. This new case provides a recent example.

The California Department of Financial Institutions closed First Bank of Beverly Hills on April 24, 2009 and appointed the FDIC as receiver. Since that date, the FDIC has combed through the bank’s loan files and determined that the bank’s former executive officers and directors approved many acquisition, development and construction (“ADC”) loans and commercial real estate (“CRE”) loans “in derogation of their duty to engage in ‘safe and sound’ banking practices.” Accordingly, on April 20, 2012, the FDIC sued 10 former officers and directors of the bank for negligence, gross negligence and breaches of fiduciary duty, seeking at least $100.6 million in damages against them. (The FDIC filed that lawsuit just 4 days before the extended statute of limitations period relating to such claims — for more information on statute of limitations issues, READI members can read “What Is the Statute of Limitations for a Lawsuit Against an Appraiser in My State?”.)

Part of what the bank’s management is alleged to have done wrong is ignore information and advice given to them by the bank’s chief appraiser. Here are two examples of that assertion from the FDIC’s lawsuit complaint against the bank’s officers and directors.

In 2006, the bank’s officers and directors approved a $20 million participation in a $28 million CRE loan on a 7-story mixed use building in Chicago. The FDIC later sold this loan participation at a resulting loss of $11,180,000. In its complaint, the FDIC alleges that the officers and directors responsible for approving the loan ignored the chief appraiser’s warnings about information missing from the underlying appraisal and about issues concerning zoning and parking. These are the FDIC’s allegations:

In 2007, the bank’s officers and directors approved a $29 million ADC loan in Las Vegas. The property contained a residential mobile home park that would have to be legally removed prior to any new development. The original appraisal for the loan valued the property at $108 million — however, that appraisal was expressly based on a hypothetical condition that all the mobile homes and mobile home tenants were appropriately moved and that the property was then properly converted for the new development. This was pointed out in the loan approval memo for consideration by the bank’s approving officers and directors. If the officers and directors had made any inquiry about it to the chief appraiser, they then would have learned that a review appraisal had been performed, raising questions about the likelihood that the property could be converted from its existing use to the new proposed development. The FDIC later sold this loan at a loss of $11,824,000. These are the FDIC’s allegations in its complaint:

Peter Christensen is an attorney who advises professionals and businesses about legal and regulatory issues concerning valuation and insurance. He serves as general counsel to LIA Administrators & Insurance Services. He can be reached at [email protected].