The Real Deal in New York recently published a story about Cushman & Wakefield, the national real estate firm, having three separate class action lawsuits in which commercial appraisers are asserting claims for unpaid overtime and other damages because the firm (or its subsidiaries) allegedly followed a practice of classifying all appraisers — whether trainees or experienced professionals — as “exempt employees.” Appraiser overtime/exempt status litigation, however, is not new for Cushman & Wakefield or for many large appraisal firms, whether residential or commercial. The lawsuits against Cushman date back to 2018 – and dozens of similar lawsuits previously have been filed against other firms over the last eight years. This is very much the current state of appraiser employment litigation.

Last week in New York, a Commercial Appraiser Sued His Former Firm for Unpaid Overtime, After the Firm Sued Him First for “Breach of Loyalty” for Taking Clients

Here’s the most recent evidence of this appraiser employment litigation phenomenon. Earlier in the summer, a large New York commercial appraisal firm filed what would normally be a fairly typical type of lawsuit by a professional firm: an action claiming that a former employee improperly took clients or sensitive information with them. In a complaint filed on July 10, plaintiff Metropolitan Valuation Services sued a former employee appraiser who had worked at the firm for about 15 years. This is Metropolitan’s basic summary of its case:

While employed by plaintiff, the individual defendant secretly incorporated a new business entity, systematically used plaintiff’s resources and property for the benefit of his new entity and solicited and obtained contracts from at least one of plaintiff’s long-time clients, causing plaintiff to sustain substantial damages and loss of business from the diverted client(s).

The former employee appraiser — a certified general appraiser — had for several years actually only been an “intermittent” employee of the firm, taking on 69 commercial assignments from the firm during the last three years of his employment. He was paid a 45% commission for those appraisals. Metropolitan alleges that he formed his own firm during this time period and improperly began performing work for one or more of Metropolitan’s clients, while also using the firm’s templates and other information.

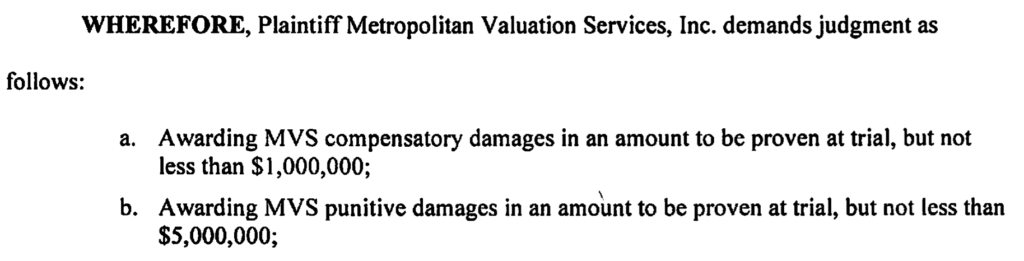

Based on such alleged facts, the firm has sued its former employee for alleged “breach of fiduciary duty and breach of duty of loyalty.” The firm demands compensatory damages of “not less than $1,000,0000” and “punitive damages . . . of not less than $5,000,000.”

While I have no involvement with any aspect of this case, I’ll offer my own thoughts about the complaint: what’s noticeably lacking from the firm’s complaint is any factual allegation that a written agreement existed between the firm and the appraiser to protect key information claimed by the firm and/or seeking to impose non-compete or non-solicitation obligations on the appraiser. These are important issues for an appraisal firm to address contractually with staff appraisers and are addressed in Chapters 23 and 24 of Risk Management for Real Estate Appraisers and Appraisal Firms.

How has the defendant appraiser responded to the lawsuit? His response is quite predictable, once you’re aware of the growing body of litigation discussed above (regularly occurring since 2012). On October 7, the defendant commercial appraiser answered the complaint and further responded with a counterclaim.

His answer to the primary claim by his former employer that he improperly took customers is essentially that, as an “intermittent” employee, there wasn’t a reasonable expectation that he would only work on assignments for the firm and, moreover, he didn’t have any agreement with the firm barring him from competing against it or otherwise restricting him. (He does admit to using the firm’s data and information sources for his own side work, but he alleges that this caused no loss to the firm and that the cost to him would have been $600 per month.)

In his counterclaim, however, the defendant appraiser has sued the firm for overtime, seeking 1.5 times his regular rate of pay for all weeks in which he worked more than 40 hours, and also for not paying him at all for some of his work and additional technical labor violations. He lists many weeks in his counterclaim in which he worked 50-70 hours.

How Did Appraiser Employment Litigation Get Here? Boyd v. Bank of America, LandSafe Appraisal.

The first signs that overtime litigation would become a widespread and significant legal problem for appraisal firms (and AMCs) came in 2012, as appraisers were being laid off at some large firms and suits started being filed. Then, in 2013, a collective action seeking unpaid overtime was filed against Bank of America and its AMC/appraisal firm LandSafe Appraisal Services in U.S. District Court for the Central District of California. After the court found that LandSafe’s appraisers were not properly classified as “exempt,” the lawsuit settled for $36 million. Hundreds of LandSafe staff appraisers received settlement checks for their unpaid overtime. Some received more than $100,000.

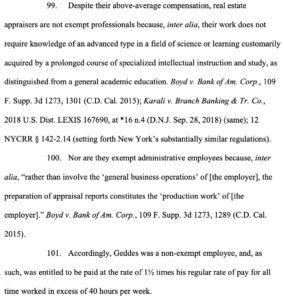

While the settlement amount was notable, the biggest impact of the LandSafe case has stemmed from the court’s order finding that the appraisers were not properly treated as exempt. The detailed order, some 61-pages in length, has since served as the primary legal tool behind dozens of other lawsuits, both individual and class actions, by appraisers and closely aligned professionals. If anyone continues to be in denial, please just take a look at a partial listing of cases that I’ve published on my site (here). Residential appraisers, review appraisers, commercial appraisers and “appraisal managers” — all have asserted class-based claims against firms, AMCs and banks employing them.

A Fourth Class Action Against Cushman & Wakefield

The Real Deal article wrote about three cases involving Cushman & Wakefield. But, there’s now a fourth class action. It was filed by the same plaintiff who had initiated the first lawsuit against the firm because the only defendant in her first lawsuit was Cushman’s western subsidiary. Her new lawsuit is filed against the parent firm. As compared to the other cases, her alleged factual story would probably be the most compelling to a jury — she worked for the firm (Cushman’s subsidiary Cushman & Wakefield Western) for over 10 years, never made it past trainee, and when terminated by the firm, it claimed she owed the firm repayment of her draw advances – that she was indebted to them. Her lawyers portray her employment situation essentially as indentured servitude.

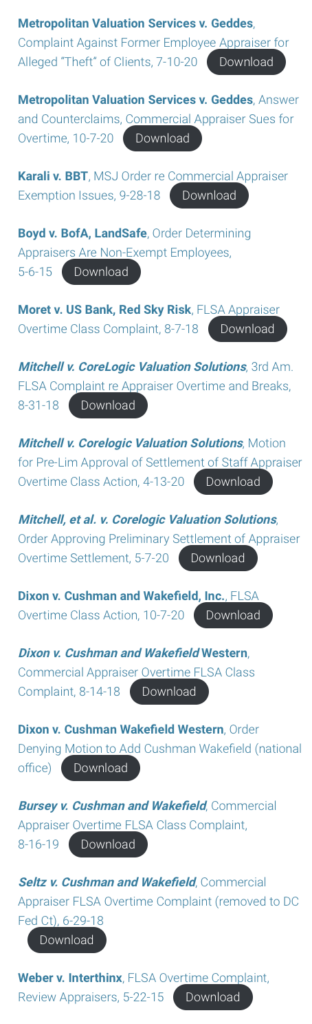

For better or worse, this is the current state of appraiser employment litigation.