Sharestates operates a crowdfunding platform that provides alternative mortgage lending secured by both residential and commercial real estate. Over the last 10 years, it has reported average annual returns for loan investors ranging from 9.24% to 11.02%. With returns like these, there is likely some loan risk – and Sharestates reports a current foreclosure rate of 2.44%.

Following several of its foreclosures, Sharestates has filed professional negligence cases against about a dozen defendant appraisers, appraisal firms and appraisal management companies, blaming the loan losses on inflated appraisals. Last year, it lost one of those cases in a Nassau County, New York court because, according to the court, Sharestates filed its lawsuit against the appraisers about 5 months too late, after expiration of New York’s appraiser-friendly 3-year statute of limitations. Now, Sharestates has appealed the trial court’s dismissal and is seeking to overturn New York’s longstanding appraiser-friendly law.

Why is the current statute of limitations law in New York friendly to appraisers?

Unlike in many other states that follow a “discovery rule,” when it comes to a negligence claim against a professional such as an appraiser, the law in New York is that the time period of its statute of limitations (3 years) begins to run when the appraiser submits the appraisal report to the client. In states that follow a “discovery rule,” the time period does not start running until the plaintiff discovers or should have discovered the alleged negligence or damages, which means that cases are often pursued against appraisers many years after the appraisal (sometimes long after the appraiser has disposed of his or her work file). Because of the appraiser-friendly law in New York, however, dozens of cases filed more than 3 years after the appraisals were completed have been dismissed. Over the years, New York’s law has been beneficial to many appraiser defendants, from the smallest appraisal firms to national commercial firms.

Sharestates’ losing case against the Long Island appraisers

Here’s a short summary of the facts of the case that Sharestates lost and is now appealing:

Two appraisers prepared an appraisal of a Kings Point, Long Island home for their client SGS Capital in February 2015. Their appraised value of the home was $4.6 million. They signed and delivered the report on February 12, 2015.

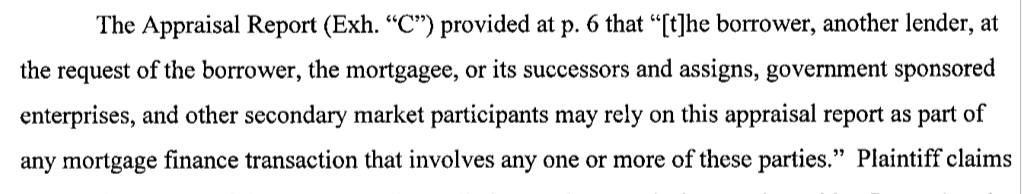

Several months later, Sharestates — who, again, was not the client on the appraisal — received a copy of the report, which was on a URAR (1004) report form. Sharestates claims that the borrower requested that Sharestates use the appraisal and claims that it permissibly relied on the appraisal because of the wording in Certification No. 23 on the URAR form:

Thus, in alleged reliance on the report, Sharestates made two loans to the borrower for $1.2 million and $160,000 secured by the property. These were second and third position loans, sitting behind an original first loan of $1.2 million by a different lender.

All three loans soon defaulted, and Sharestates foreclosed. After the property sold at auction for $3,050,000, Sharestates claimed it was left with unpaid principal, interest and other charges totaling $1,169,000. And, on July 20, 2018, it sued the appraisers and the appraisal firm, seeking to recover that amount from them.

The appraisers filed a motion to dismiss based on the statute of limitations. The trial court granted their motion, ruling that the 3-year statute of limitations period, under New York’s long-established caselaw, began running when the appraisers submitted the appraisal to their client. Thus, according to the trial court, Sharestates’ lawsuit should have been filed no later than in February 2018 — but was filed about 5 months too late in July. Sharestates unsuccessfully argued that the time period for its claim should have started at the earliest when it actually suffered damages (either when it foreclosed or alternatively when it extended the loans). This is the basic argument that it will likely pursue on appeal.

If Sharestates prevails on its appeal, the change could be quite dramatic for future claims against appraisers in New York.

This is the trial court’s full decision that Sharestates seeks to overturn:

For information about the statute of limitations in other states, please see my earlier post: What’s the Statute of Limitations for Suing an Appraiser in My State?