In the last three months, since May 1, 2012, the Federal Deposit Insurance Corporation (FDIC) has sued 45 individual appraisers and appraisal firms in its capacity as receiver for one of the failed banks or lending institutions under its supervision. The appraisers targeted by the FDIC in its recent cases are a more diverse group, geographically and professionally, than in earlier cases, but in other respects the FDIC’s recent cases represent more of the same familiar story — suing appraisers to recover money damages for allegedly appraising properties too high for loans extended during the peak of the real estate bubble which are now in default.

Here are the facts regarding the FDIC’s recent cases against appraisers:

- The defendant appraisers in the FDIC’s lawsuits since May 1, 2012 reside in the following states and localities:

- California: Aptos, Chatsworth, Huntington Beach, Larkspur, San Jose, Tracy.

- Florida: Boca Raton, Bradenton, Estero, Ft. Lauderdale, Hollywood, Hudson, Jacksonville, Lake Worth, Port Charlotte.

- Illinois: Chicago, Skokie, South Elgin.

- Michigan: Detroit, Macomb County.

- Minnesota: Chisago County.

- North Carolina: Union County.

- New Jersey: Bergen County.

- New York: Suffolk County.

- South Carolina: Lexington.

- Washington: Tacoma.

- Four of the appraisals at issue relate to commercial or development properties.

- All of the appraisals at issue were performed in 2004 through 2008.

- All of the claims by the FDIC allege that the defendant appraisers were too high in their opinions of value.

- Several of the appraisers recently sued may not have E&O insurance coverage for the damages demanded by the FDIC because they either now have an E&O insurance policy with an FDIC exclusion (or “regulatory agency” exclusion) or have no insurance covering their prior appraisal work.

- It continues to be the case that the FDIC, almost without exception, only files lawsuits seeking money damages against appraisers for allegedly appraising too high. Though it has a statutory duty under FIRREA to report USPAP violations and other appraiser problems to state regulators, the FDIC files virtually no disciplinary complaints.

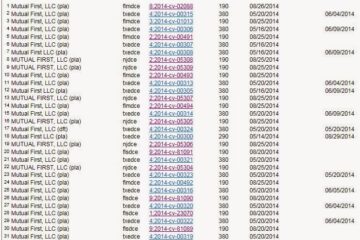

Examples of some of the FDIC’s recent cases filings are available on Appraiser Law here.

Peter Christensen is an attorney who advises professionals and businesses about legal and regulatory issues concerning valuation and insurance. He serves as general counsel to LIA Administrators & Insurance Services. He can be reached at [email protected].